I’ve been interested in learning more about investing in green energy lately. My exploration has been taking me down some shady alleys, and most recently into the realm of hydrogen fuel cell technology. These are some of the things I've learned...

I’ve been interested in learning more about investing in green energy lately. My exploration has been taking me down some shady alleys, and most recently into the realm of hydrogen fuel cell technology. These are some of the things I've learned...This past weekend, during a blowout bachelor party for his brother at several undisclosed locations, Jae learned an interesting fact about investing, energy, and government from his brother’s friend, Ben (not his real name). Ben, a Wall Street trader, said that if you want to make money in the stock market, follow the sectors that government invests in. If government isn’t investing in it, then it isn’t going to bring big returns.

In terms of the energy industry, the government has its money in oil in the form of subsidies, infrastructure investment, reserves, tax breaks, and so on. Hence, oil will bring you big returns if you invest in it. But what does that leave for socially- and environmentally-conscious investors? Well, Ben said, you can invest in windmills and solar power all you want, but the government doesn’t have any money there so it’s not going to perform impressively in the short term. Period.

Ok, if that’s the case, then maybe we should all invest in hydrogen fuel cell technology, since that’s the solution Bush always points to whenever the high price of gas or global warming draws criticism. "I strongly believe hydrogen is the fuel of the future," said Bush on Earth Day, describing a vision of today’s children taking their driving test in hydrogen fuel cell cars. Hard to imagine the government reallocating funds from oil to hydrogen fuel cell (HFC) technology, but maybe Bush realizes we need alternatives since we’re so “addicted to oil.”

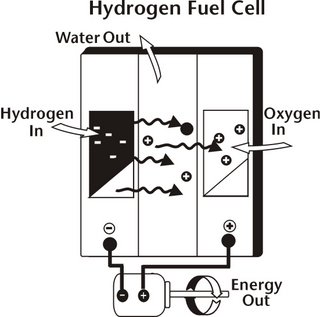

It didn’t take much digging to learn there is little risk to the oil industry if HFCs became standard issue since it takes so much energy to produce the technology. Evidently, no studies have been done on this in terms of the Energy Return on Energy Invested (EROEI), but it takes considerable amounts of energy to liquefy and refrigerate hydrogen so it remains in a liquid (i.e. useful) state, and also to produce the hydrogen in the first place since in nature it’s always found combined with other elements and therefore needs to be separated to be useful (click here to learn more). The energy used to do these tasks would most likely be fossil fuel-based, so by many estimates it takes so much energy to create the hydrogen fuel cells that the EROEI is dramatically decreased, and in fact it may be a wash.

Since HFC technology still relies heavily on fossil fuels, maybe that’s why Bush supports fuel cells instead of hybrid technology or fuel efficiency standards: he can without upsetting the status quo of King Oil. And compared with these other two technologies that are both on the fast track to marketability, many analysts say a hydrogen energy system will take decades and tens of billions of dollars to develop. So it’s a safe enough distance off to be no threat.

The question from an investment standpoint is, where are those billions of dollars going to go? Car manufacturers are one place, since automakers like GM are already deeply involved in HFC research on the government’s dime. According to the Times, “The General Motors Corporation and the Department of Energy have committed $44 million to a fuel cell demonstration project, with G.M. pledging to put 40 fuel cell vehicles on the road in New York, Washington, California and Michigan by 2009. The department has also signed fuel cell development agreements with the Ford Motor Company, DaimlerChrysler and the Hyundai Motor Company as part of a broader, five-year, $1.2 billion hydrogen initiative announced by Mr. Bush in his 2003 State of the Union address.”

Does that mean we should invest in car manufacturers? I’m not sure how “green” that is (though maybe it's getting greener -- click here). And besides, the government is investing some money in other alternatives. From the Times: “Bush's energy proposals for the fiscal year that begins in October call for $289 million for hydrogen fuel technology, up from $53 million this year; $54 million for coal plants that would capture the carbon dioxide they produce; $148 million for solar power, up from $65 million this year; $44 million for wind power, up $5 million from this year; and $150 million for ethanol from cellulose, up $59 million from this year.” By comparison, the funding for the National Endowment for the Arts in 2006 is $121 million…

I don’t think Bush has in mind any five-year, $1.2 BILLION initiative for wind, solar, or arts. So those areas probably aren’t going to yield “big returns” in the stock market. And we should probably be thinking in terms of smaller, more sustainable returns on investments anyway.

None of this is to say there's no use investing in alternative energy. On the contrary, some say that green is the new Internet. There are venture capitalists out there pouring money into alternative energy and "greentech" companies that can make for very fertile investment opportunities. "The green, sustainability movement is going mainstream," AOL-founder Steve Case told The Washington Post last year, and "we want to ride that wave." (Click here for article.) The World Bank is even getting on the bandwagon. In the case of green, since Bush administration seems to be so far behind, perhaps we don't have to wait for the government to invest before strong returns are possible. Those of us interested in investing green sure hope so!

One thing I’ve learned through this exploration is, despite Bush's lip service, if you want to follow where government is investing to make your big bucks, it’s gonna come back around to oil. And maybe the Wall Street trader isn't looking at the whole picture. Because two things are for certain: there's nothing about oil that's green, and if the government won't take the lead on green investing, it's up to us. And a few likeminded billionaries...

No comments:

Post a Comment